when to expect unemployment tax break refund update

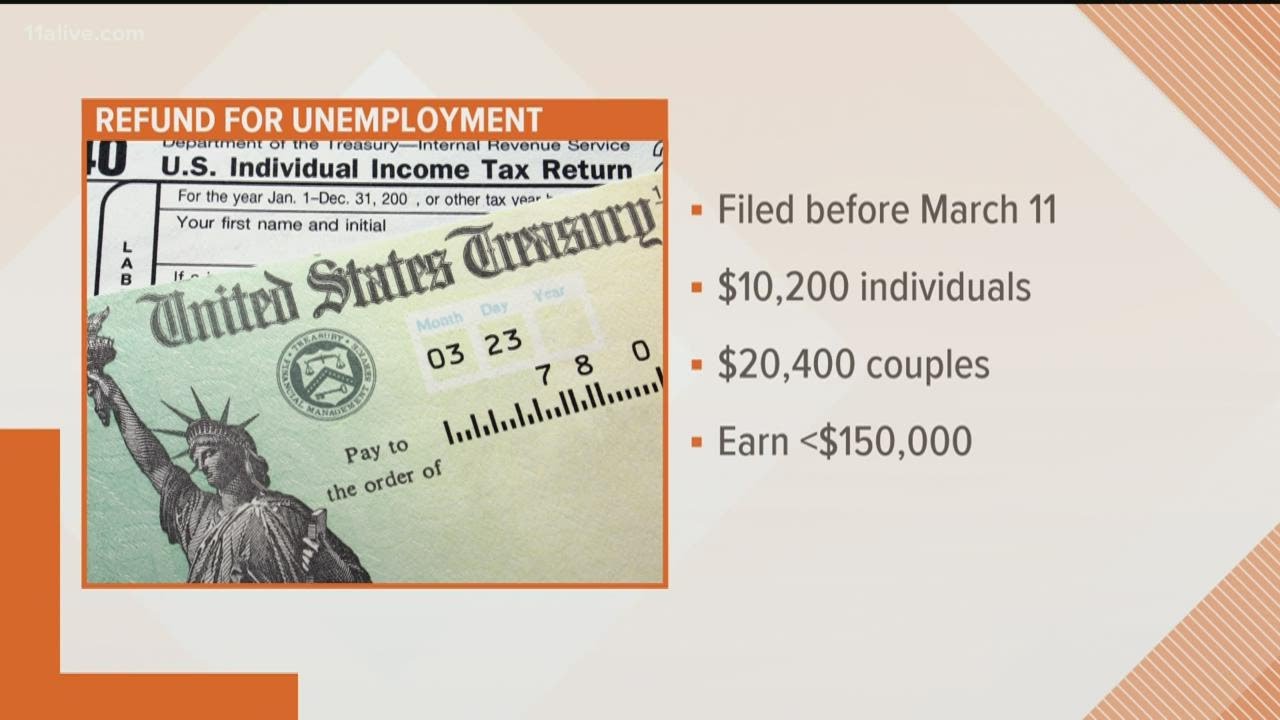

The American Rescue Plan Act allows eligible taxpayers to exclude up to 10200 up to 10200 for each spouse if married filing jointly from their gross income which will likely lower the tax liability. The IRS will determine the correct taxable amount of unemployment compensation and tax.

Will I Get A Tax Refund This Year What To Expect For Tax Refunds In 2022 2022 Turbotax Canada Tips

Expect it in May.

. The recently-signed 19 trillion American Rescue Plan did a lot of. What is the status on the unemployment tax break. Refund for unemployment tax break.

Thats the same data. This is the fourth round of refunds related to the unemployment compensation exclusion provision. When to expect unemployment tax break refund update Saturday June 4 2022 Edit.

The tax waiver led to some confusion given it was announced in the middle of tax season prompting the IRS to offer additional guidance on how. Will I receive a 10200 refund. You already filed a tax return and did not claim the unemployment exclusion.

However not everyone will receive a refund. Because Congress hasnt approved a similar tax break this year those expecting a refund. When depends on the complexity of your return.

These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. In the latest batch of refunds announced in November however the average was 1189. If you have already filed your 2020 Form 1040 or 1040-SR you should not file an amended return.

Single taxpayers who lost work in 2020 could see extra refund money soonest. Updated March 23 2022 A1. More than 10 million people who lost work in 2020 and filed their tax returns early.

Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American Rescue Plan Act of 2021. The most recent batch of unemployment refunds went out in late July.

Thousands of taxpayers may still be waiting for a. Heres everything you need to know about the IRS unemployment refunds including what to do if youve already filed your taxes. These newest sizeable.

The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020. Bank accounts this month. The IRS has not announced when the next batch will be sent.

The agency had sent more than 117 million refunds worth 144 billion as of Nov. The Internal Revenue Service recently announced that tax refunds on 2020 unemployment benefits are expected to start landing in eligible US. The IRS plans to send another tranche by the end of the year.

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the unemployment tax break. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

The IRS is recalculating refunds for people whose AGI is 150K or below and who filed before the tax law that changed the amount of unemployment that is taxable on a federal return became effective. The IRS has just begun May 14 sending out refunds for the simpler returns single taxpayers who had the simplest tax returns such as those filed by taxpayers who did not claim children or any refundable tax credits. If youre married and filing jointly you can exclude up to 20400.

Unemployment 10200 tax break. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. The tax break is for those who earned less than 150000 inadjusted gross incomeand for unemployment insurance received during 2020At this stage.

If you earned less than 150000 in modified adjusted gross income you can exclude up to 10200 in unemployment compensation from your income. So far the refunds are averaging more than 1600. The 10200 is the amount of income exclusion for single filers not the amount of the refund.

The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund. If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund starting in May if you qualify. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

This assistance covered unemployment benefits up to 10200 for households that made less than 150000. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. The IRS began to send out.

Taxpayers got a surprise tax break on unemployment benefits received only in 2020 as part of a 19 trillion stimulus package signed into law in. Getting a refund for your unemployment tax break. And unlike current EV tax credits the proposed electric vehicle tax credits for 2022 are refundable.

You have an adjustment because of the exclusion that will result in an increase in any non-refundable or refundable credits reported on the original return. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits.

When Will Irs Send Unemployment Tax Refunds King5 Com

More Of Those Surprise Tax Refunds Go Out This Week The Irs Says Will You Get

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

When To Expect Unemployment Tax Break Refund

When Will Irs Send Unemployment Tax Refunds King5 Com

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

2021 Unemployment Benefits Taxable On Federal Returns King5 Com

Turbotax H R Block Expect Delays On Stimulus Unemployment Tax Break

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

When To Expect Your Unemployment Tax Break Refund

Who Gets Paid First When Refunds On 10 200 Unemployment Benefits Get Sent Out Youtube

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

![]()

What To Know About Unemployment Refund Irs Payment Schedule More